Thematic Investment Insights

Key Highlights:

- Physical climate risks are increasingly recognised as financially material, with global economic losses from natural disasters exceeding USD 4tn over the past 50 years.1 However, only 40 per cent of the USD 280bn in losses from natural catastrophes in 2023 were insured.2

- Asset managers have traditionally focused on transition risks, but the growing frequency and severity of physical risks demand enhanced research and integration into investment strategies. Both top-down and bottom-up approaches offer valuable insights for strategic asset allocation and security selection

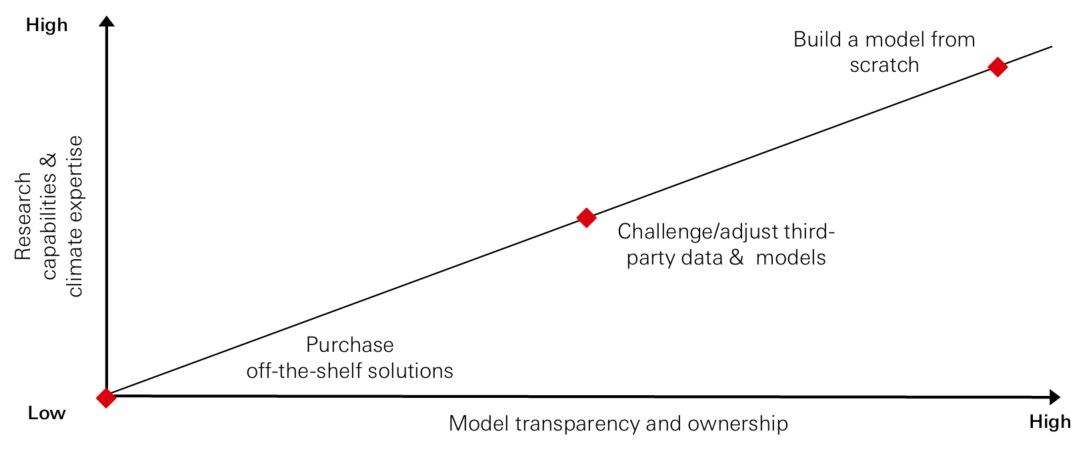

- A “build or buy” dilemma exists in climate-risk modelling. While in-house models provide transparency and control, third-party solutions offer immediate insights. A hybrid approach, leveraging a continuum of modelling options, can tailor solutions to specific investors’ needs

1 - World Meteorological Organization, “Economic costs of weather-related disasters soars but early warnings save lives”, May 22, 2023.

2 - Swiss Re Institute, “Sigma, Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks”, No 1/2024.

In a nutshell

- Physical climate risks are increasingly recognised as financially material, with significant implications for global output and investment portfolios. Over the past 50 years, the total economic impact of natural disasters has been estimated at USD 4.3tn1. Losses from natural catastrophes reached USD 280bn in 2023, with only 40 per cent insured2

- Asset managers have traditionally focused on transition risks, such as regulatory and technological changes, due to their immediacy and alignment with existing expertise. However, growing frequency and severity of physical risks linked to climate change demand enhanced research and integration into investment considerations

- Physical risk analysis can be approached through top-down methods (macro-level impacts) or bottom-up methods (issuer-specific exposures). Each approach provides valuable insights for the use case, whether strategic asset allocation or security selection

- There remains a "build or buy" dilemma in climate risk modelling. Developing in-house models offers transparency and control, while third-party solutions provide immediate insights but limited flexibility. A hybrid approach can be a practical solution depending on the specific needs of the asset manager

- A continuum approach to physical risk modelling allows asset managers to tailor their approach based on their expertise, data budgets, and client needs, leveraging third-party data, enhancing existing models, or building proprietary solutions.

1 - “Economic costs of weather-related disasters soars but early warnings save lives,” World Meteorological Organization, May 22, 2023.

2 - Swiss Re Institute, “Sigma, Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks”, No 1/2024.

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

The growing financial impact of physical climate risks won’t be equally distributed across countries and companies.

Physical risks are financially material, but consensus on the impacts is lacking

Physical climate risks have become increasingly recognised as financially material, with significant implications for global GDP. Over the past 50 years, the total economic impact of natural disasters has reached over USD 4tn, although this figure may be an underestimate1. Losses from natural catastrophes, not limited to climate-induced events, amounted to USD 280bn in 2023. Only 40 per cent of these losses were insured2. Extreme heat alone has resulted in estimated cumulative losses ranging from USD 16tn to USD 50tn between 1992 and 2013.

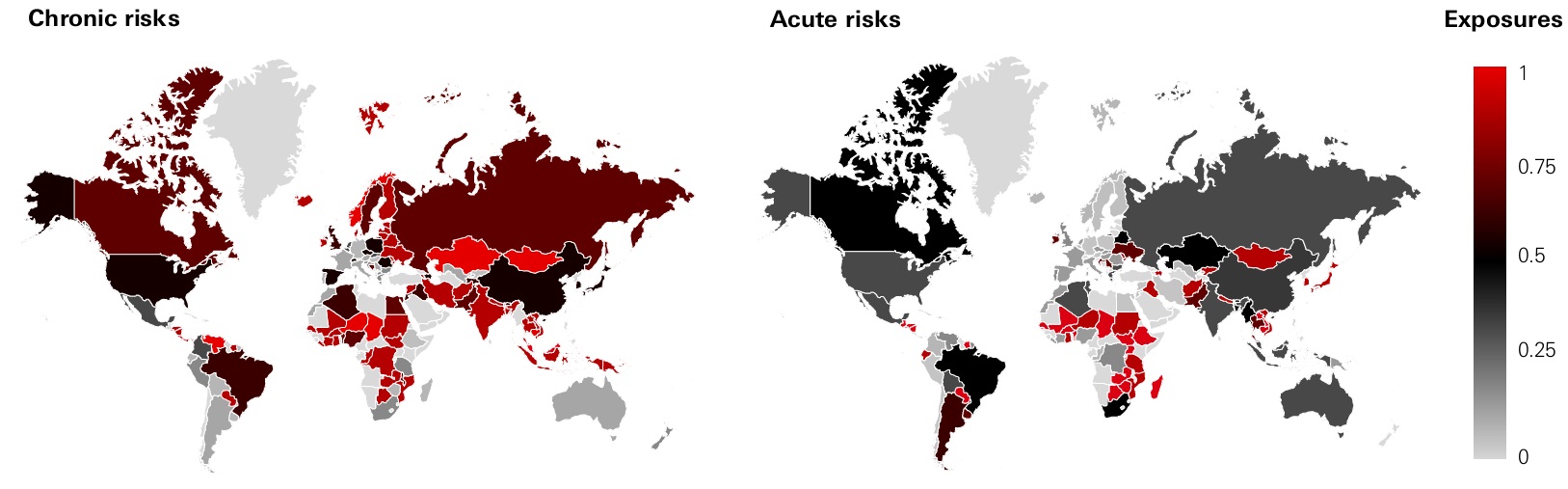

As Figure 1a shows, the severity of natural hazards, particularly chronic, appear relatively higher across some of the developing countries. Countries at greatest risk are those that have a large share of assets severely exposed to several perils, like the US and China (Figure 1b).

Figure 1a: Globally, countries’ exposure to physical risk varies significantly: the Global South most and Europe least affected.

Countries’ exposure to natural hazards in a 3°C Nationally Determined Contributions Scenario, calculated based on the exposures of individual listed companies with assets in these countries.

Click the image to enlarge

Source: HSBC Asset Management, as of April 2025. For illustrative purpose only. Data: Granular dataset from MSCI detailing the exposure of individual companies to acute and chronic perils, categorised by severity in quartiles. Exposures are represented as a percentage of each company's assets within a specific country, peril, and quartile. For illustrative purposes only. Any views expressed were held at the time of preparation and are subject to change without notice.

1 - “Economic costs of weather-related disasters soars but early warnings save lives,” World Meteorological Organization, May 22, 2023.

2 - Swiss Re Institute, “Sigma, Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks”, No 1/2024.

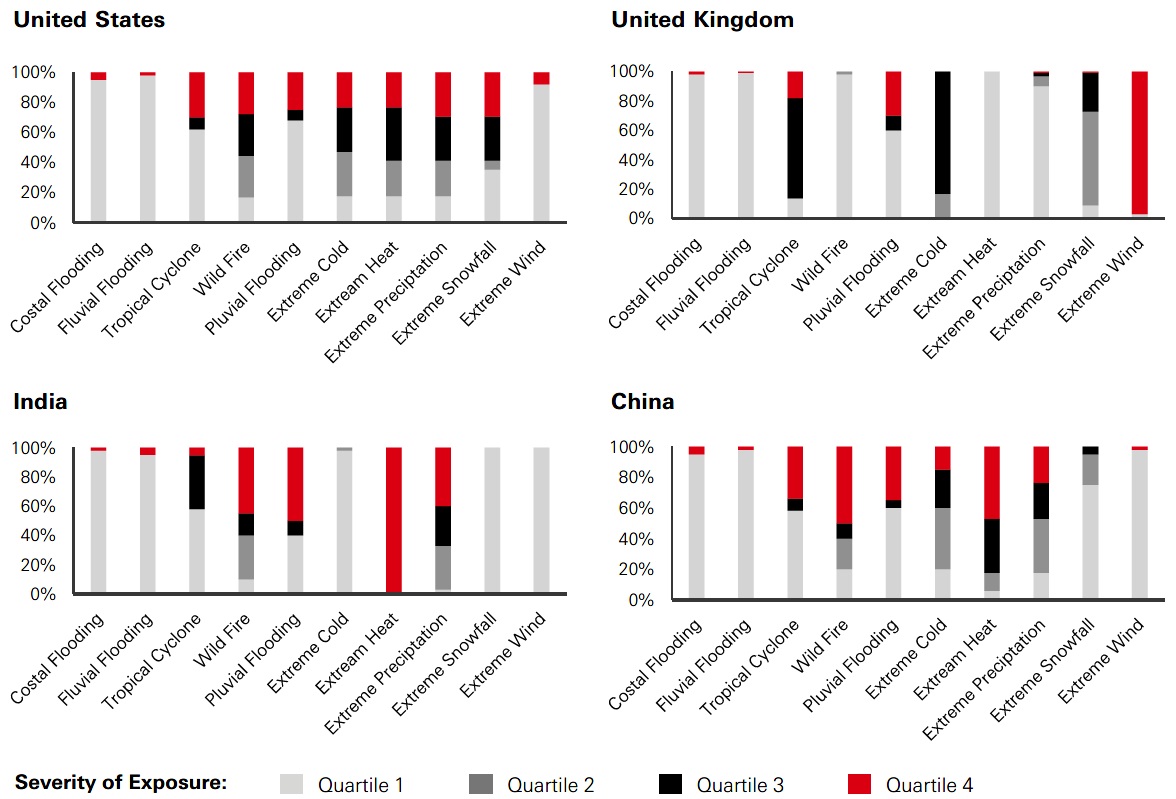

Figure 1b. Countries at greatest risk would have more assets in higher severity quartiles for most perils.

The share of countries’ assets exposed to different levels of natural hazard severity in a 3°C Nationally Determined Contributions Scenario, calculated based on the exposures of individual listed companies with assets in these countries.

Click the image to enlarge

Source: HSBC AM, April 2025. Data: Granular dataset from MSCI detailing the exposure of individual companies to acute and chronic perils, categorised by severity in quartiles. Exposures are represented as a percentage of each company's assets within a specific country, peril, and quartile. For illustrative purposes only. Any views expressed were held at the time of preparation and are subject to change without notice.

Besides the exposure, what matters is the economic implications of these impacts on countries’ economies. Evidence exists that the economic burden of physical risks could be disproportionately felt by lower-income countries, where the bottom income decile experiences annual losses equivalent to 8 per cent of GDP per capita, compared to 3.5 per cent for the top income decile3.

Despite the evident financial implications of physical risks, uncertainty about past losses reflects also in the lack of consensus regarding the magnitude of future impacts. Estimates of climate change's impact on GDP in a 3°C scenario vary widely, with projections ranging from a loss exceeding 70 per cent by 2100 to some scenarios suggesting GDP growth4. This uncertainty is compounded by the fact that economists may consistently underestimate the impacts of climate change, with some peer-reviewed studies indicating potential losses of less than 10 per cent even in the case of a 6°C warming, which is considered catastrophic by climate scientists 5. As such, understanding the financial materiality of physical climate risks requires investors to enhance their research and data capabilities to adequately incorporate potential economic and financial consequences into their decisions.

3 - Christopher W. Callahan and Justin S. Mankin, “Globally unequal effect of extreme heat on economic growth,” Science Advances, Vol. 8, no. 43, 2022.

4 - Sandy Trust, Sanjay Joshi, Tim Lenton, et al., “The Emperor’s New Climate Scenarios: Limitations and assumptions of commonly used climate-change scenarios in financial services,” Institute and Faculty of Actuaries and University of Exeter, July 2023.

5 - Carbon Tracker, “Loading the DICE against pension funds Flawed economic thinking on climate has put your pension at risk”, July 2023.

Transition risks have traditionally been the investment focus

Traditionally, asset managers have concentrated on transition risks — those associated with the shift to a low-carbon economy, such as regulatory changes, technological advancements, and market shifts — rather than on physical risks. This emphasis stems from three primary reasons.

- Transition risks align closely with asset managers’ expertise. Equity and credit analysts possess a deep understanding of the companies they cover and factors that may affect their performance, including the underlying policy and regulatory environments and the competitive landscape shaped by emerging technologies. Physical risk assessment may require a different type of specialist expertise

- Transition risks are often considered more immediate. For instance, sustainability-related regulatory requirements for disclosures, the naming of investment products, or carbon pricing policies affecting investee companies present more immediate challenges. In contrast, physical risks may appear more distant and uncertain, particularly given the staggering range of projections regarding their future impact on GDP

- Assessing the potential costs of physical risks requires high-quality granular datasets, including chronic and acute perils by location, and the precise locations of investee companies’ assets globally, along with scientific climate risk expertise

Despite the traditional focus on transition risks, the increasing frequency and severity of natural hazards linked to climate change have thrust physical risks into the spotlight of investment research. This shift requires investors to understand and integrate these risks into their decision-making processes.

We will now explore various research avenues related to physical risk for different investment use cases, aiming to demystify the topic and discuss the necessary data and modelling requirements.

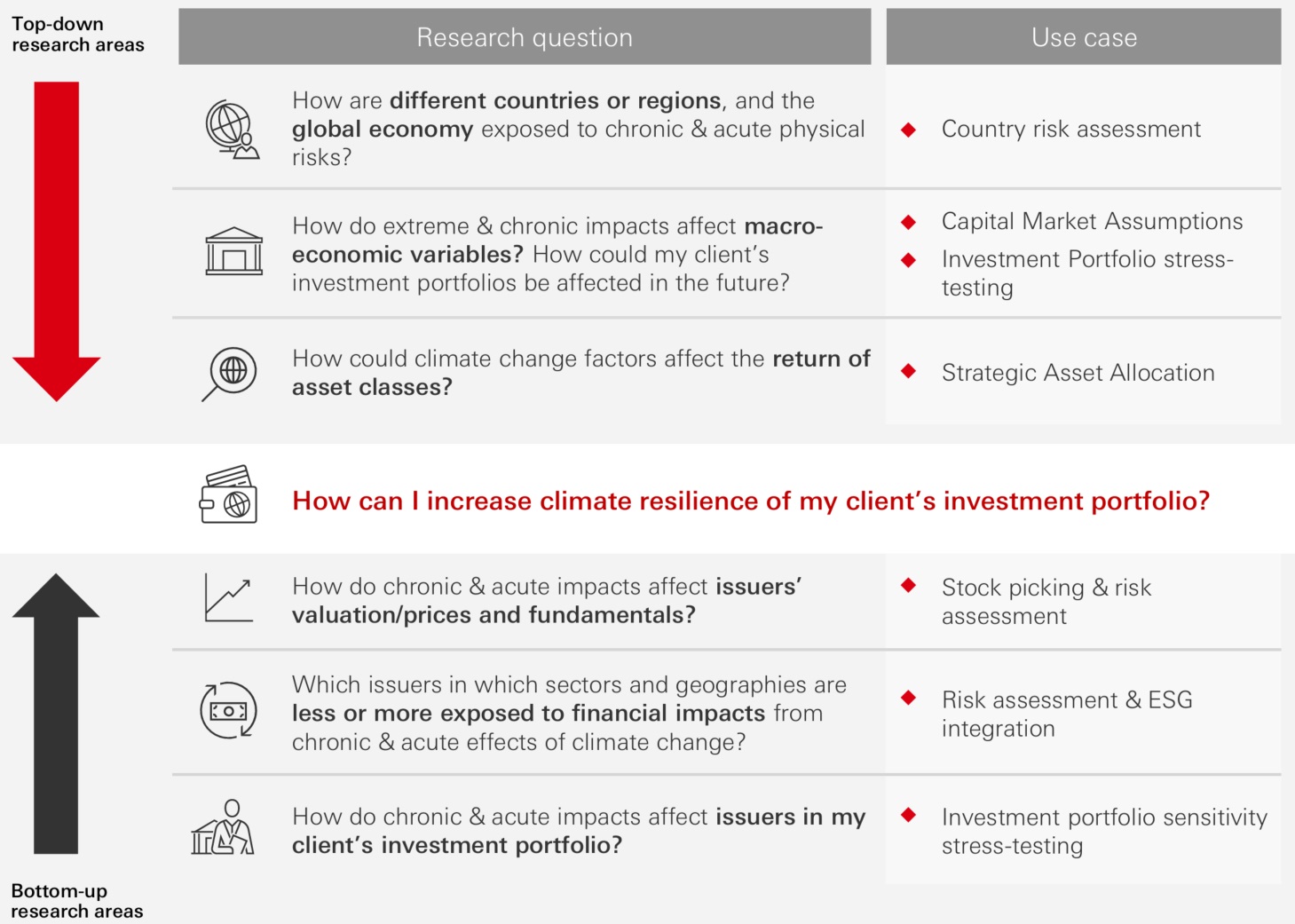

Top-down vs bottom-up perspectives

Physical risks in climate scenario analysis can be approached from both top-down and bottom-up perspectives, depending on the investment use case.

- Top-down research: This approach focuses on the macro-level impacts of climate change on the global economy, individual countries, or asset classes. For example, a Macro Strategy or Multi-Asset Team might examine how climate change affects macroeconomic variables and asset class returns. A macro strategist could ask: How does climate change influence macroeconomic variables and, by extension, my clients' investment portfolios? Meanwhile, a multi-asset portfolio manager might inquire: How can I enhance the climate resilience of my clients’ investment portfolios by adjusting asset allocation towards lower-risk assets?

- Bottom-up research: In contrast, an equity or fixed income portfolio manager could be interested in assessing their client’s portfolios' exposure to physical risks on an issuer-by-issuer basis. They might ask: Which companies in which sectors and geographies are least and most exposed to climate change? How can I integrate this information in my client’s portfolio to bolster its climate resilience? How can I integrate this information in the valuation of the securities I am analysing?

Figure 2: Various entry points for physical risk analysis in investment portfolios from top-down and bottom-up perspectives

Click the image to enlarge

Source: HSBC Asset Management, as of April 2025.

The build or buy dilemma in navigating physical risk data and modelling needs

Once asset managers clarify their research questions and use cases for physical risk analysis, they face a critical challenge: to buy or to build. Modelling the impact of physical risks — whether from a top-down or bottom-up perspective — is a complex task that requires large, high-quality datasets and advanced modelling capabilities.

On one hand, off-the-shelf solutions from third-party providers can provide immediate insights into portfolio exposure, alleviating the pressure on asset managers to conduct the modelling themselves. For example, Climate Value at Risk (CVaR) metrics provide an estimate of climate-stressed market valuation of an issuer or investment portfolio, useful to identify portfolio exposure to climate risks and opportunities.

However, relying on off-the-shelf solutions comes with drawbacks. First, users inherit all the assumptions made by the data provider, which can significantly influence the results. For example, assumptions around the ability of companies to adapt to physical risks, or the magnitude of second-order effects of physical risks through the impact on companies’ supply chains. Second, being based on complex modelling, climate metrics often constitute a black box, leaving users with limited understanding of the inner workings of a third-party model, which may undermine user confidence in the model and results.

Finally, the flexibility to adjust inputs and assumptions feeding into the models, based on an asset manager’s expertise and conviction is frequently limited, with providers offering take-it-or-leave-it solutions. Asset managers possess a deep understanding about policy and market contexts in which their investee companies operate, and how their companies might be able to respond.

On the other hand, building climate risk capabilities in-house would allow asset managers full transparency and control over the model and its assumptions, as well as the flexibility to tailor modelling to their specific use cases and client needs. However, developing and maintaining climate risk models internally requires substantial data, modelling capabilities, and, most importantly, large, specialised research and technology teams.

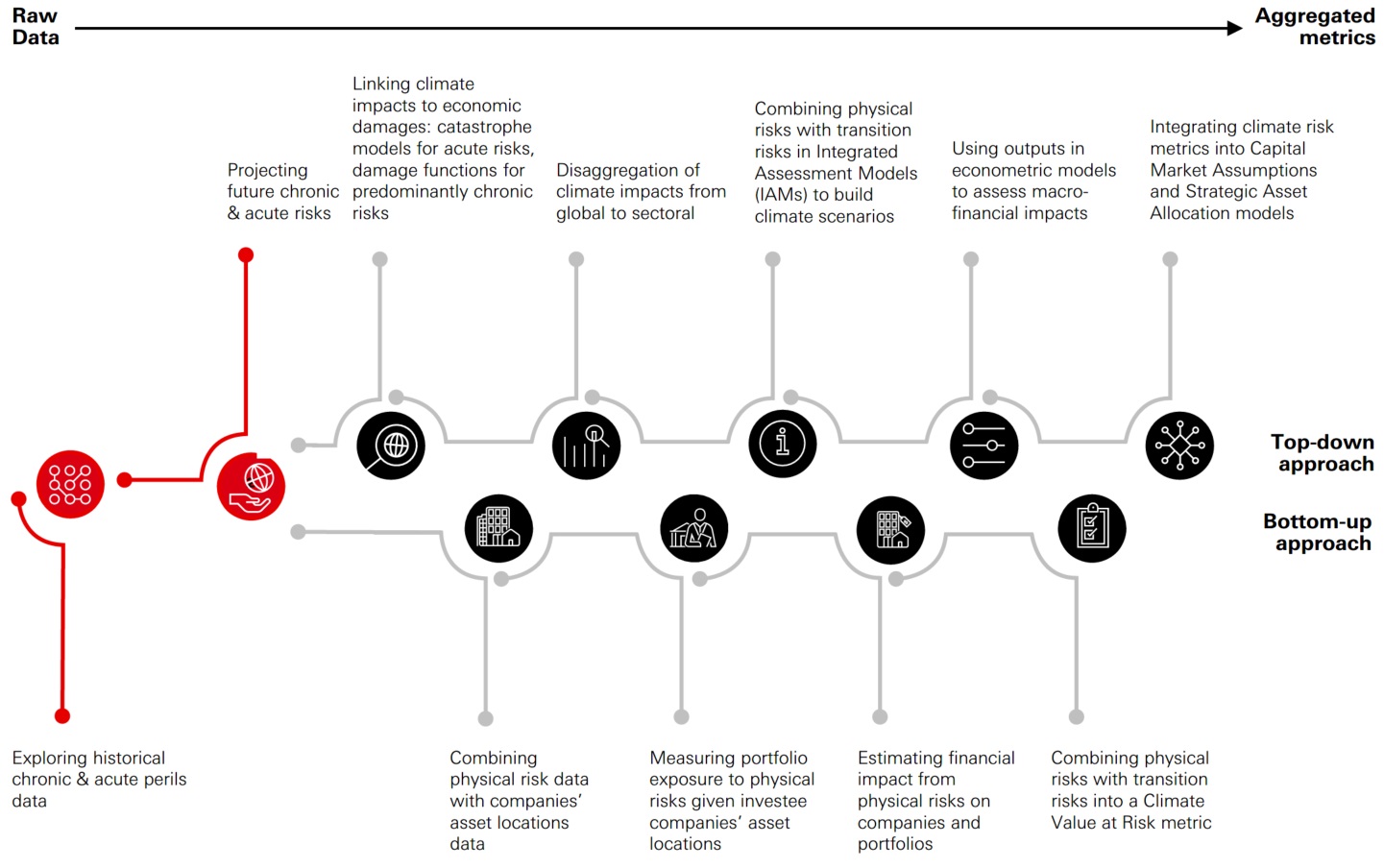

Thinking of climate risk modelling as a continuum

That said, physical climate risk data and modelling do not have to be an all-or-nothing endeavour. Despite the complexities involved, there is considerable flexibility available to asset managers and their asset owner clients. They can choose to address all or some use cases through off-the-shelf solutions while developing in-house models to meet other specific needs.

It is helpful to conceptualise physical risk modelling as a continuum (see Figure 3a), ranging from granular data on the frequency and severity of historical physical hazards and their geographic locations to more aggregated outputs, such as a CVaR metric at the company or investment portfolio level for bottom-up risk assessments. For top-down analyses, this could involve outputs from climate scenario models, such as off-the-shelf scenarios from the Network for Greening the Financial System (NGFS) or bespoke climate scenarios developed internally by the asset manager.

Depending on their starting position—such as climate risk expertise, data budgets, and modelling infrastructure—asset managers can approach physical risk modelling from various entry points along this continuum. For example, they might choose to build a climate risk economic model from scratch, which would require a substantial team of quantitative researchers. On the other end of the spectrum, they could opt for an open-source or third-party climate scenario model, using it as is. Another middle-ground option, should data providers be open to it, is to enhance a third-party model by adjusting assumptions and collaborating with the data provider to expand its capabilities. Asset managers could also select specific outputs from the model and integrate them into their internal analyses, such as Capital Market Assumptions.

From a bottom-up perspective, an asset manager may decide against using an off-the-shelf CVaR model but not go down the full proprietary route either to develop a comprehensive in-house catastrophe risk model or collect physical asset data for all investee companies in its portfolio. Instead, it may be more practical to purchase climate hazard data and asset-level information, using this as a foundation for building their climate risk exposure research.

These various options come with differing levels of transparency, ownership, flexibility and control over the model, as well as varying costs to in-source expertise, data, and modelling capabilities.

Figure 3a: Climate risk data and modelling continuum, ranging from granular data on to aggregated metrics

Click the image to enlarge

Source: HSBC Asset Management, as of April 2025.

Figure 3b: In-house modelling requires advanced capabilities, but off-the-shelf solutions provide limited transparency and control

Click the image to enlarge

Source: HSBC Asset Management, as of April 2025.

Leveraging the flexibility and gradually advancing research capabilities

Asset managers have traditionally focused on transition risks associated with the shift to a low-carbon economy, but the increasing financial significance of physical climate risks necessitates a broader perspective to continue generating returns for clients.

Asset owners are probing their managers on their thinking around the current and future exposure of their portfolios to physical risks and how to adjust asset allocations to increase climate-resilience in their investment strategies.

Given the complexity of physical risk modelling, which requires new data and expertise, asset managers can choose from various entry points along the modelling continuum, ranging from granular raw climate data to sophisticated impact metrics.

They can also choose to conduct the analysis fully in-house to address all or specific needs, or they can purchase ready-made solutions from third-party providers for various use cases, with each option offering its own advantages and drawbacks.

This flexibility allows asset managers to tailor their research approaches based on their own expertise, and most importantly, the needs of their clients.

Source: HSBC AM, June 2025. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. The information provided is for illustrative purpose only.